John Oberlin: The debt crisis is a republican blackmail scheme they only use when there's a democrat POTUS.

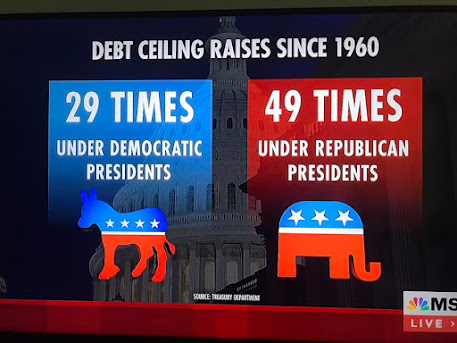

They raised it three times for Trump for his $2 trillion tax cuts for rich people and another $4 trillion is excessive corporate welfare.

Now they want to blame Dems

18 comments:

There's no bottom for these anti-America, democracy-hating fascists.

“I can’t even imagine anyone using the debt ceiling as a negotiating wedge. That’s a sacred element of our country.” — Trump before he told McCarthy to tank our economy now that Biden is president.

The reality is Shaw that this country does have a debt problem. With the carrying costs what they are it is likely this nation will never pay down our obligations.

I fully understand the republicans stated concerns over our suffocating national debt. I also know that it is completely and wholly disingenuous. They are only concerned when a democratic president is in power. Other than that, as you clearly demonstrate, when in complete power and control they spend like drunken sailors while decreasing taxes.

Republicans are most responsible for the size of our national debt regardless the delusional BS they try pass off as truth.

But we do need to be concerned and should be working honestly to structure spending and taxes so as to at least stabilize it and manage it better going forward. Whatever that needs to look like.

Fact... 40% of the current debt was accrued during the Trump Admin.

Fact... Trump as president said we should not negotiate on the debt limit.

Fact... the Dems joined the GOP to cleanly raise the debt three times during his admin.

Want to lower our debt? Repeal the trump tax cuts.

Easy peasy...

Rev, You are correct in some things you stated but if you look at percentages FDR was #1 and trump was #2. This was due to WW2 and outrages spending for covid. Joey b has added trillions n a short period of time so I am sure he will pass FDR, BHO and DJT buy the time his term is up.

Why do we have a debt limit if we are not going to stick to it. I think that is called politics because it gives the no presidential party a method to embarrass the other party. I am for either sticking to the limit or just do away with it and print more money because we won't have to deal with it, our grand kids will. Every time the debt ceiling is being reached you see ads about how SS and medicare will not be paid but you don't see welfare and congress paychecks being affected. Strange isn't it.

Now it costs us more to service the debt than pay for it which is a real problem. We want to pay for rich kids tuition and border crossers cell phones and living expenses but we balk at limiting paying off what we owe. Maybe we should just balk at raising the debt and see what happens. Of course the dems would blame the repugs and vice versa but we should try it.

Rev, I forgot, maybe EVERYONE should pay their Fair Share of taxes and that would solve our debt issue. The tax cuts have little to do with the debt, it is about the spending.

skud,

"Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio

Without the Bush and Trump tax cuts, debt as a percentage of the economy would be declining permanently.

The need to increase the debt has focused attention on the size and trajectory of the federal debt. Long-term projections that federal debt as a percentage of the U.S. economy is on a path to grow indefinitely, with increased noninterest spending due to demographic changes such as increasing life expectancy, declining fertility, and decreased immigration and rising health care costs permanently outstripping revenues under projections based on current law.

House Republican leaders have used this fact to call for spending cuts, but it does not address the true cause of rising debt: Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues.

In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more. If not for the Bush tax cuts and their extensions — as well as the Trump tax cuts — revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded. Eventually, the tax cuts are projected to grow to more than 100 percent of the increase."

SOURCE

skud,

April 3, 2023

"Republicans in Congress argue that federal spending has grown so out of control and created such a severe budget deficit that we should default on the national debt accumulated under previous Congresses of both parties if the President doesn’t agree to substantial spending cuts. They know full well that such a debt default would spark an economic cataclysm, but the premise underlying their argument – that overspending by the federal government has caused the budget deficit – is wrong, according to a new report from the Center for American Progress. The real problem is that tax cuts have drained trillions of dollars from federal coffers – tax cuts that have mostly enriched the wealthiest Americans.

The report points out that as recently as 2012, the Congressional Budget Office projected the federal government would indefinitely collect more than enough revenue to cover federal spending outside of interest payments on the debt, meaning the debt would fall over time."

SOURCE: INSTITUTE ON TAXATION AND ECONOMIC POLICY

And we can't ignore what is probably behind this impasse:

"Late last week, amid the on-again/off-again White House negotiations with House Speaker Kevin McCarthy on raising the debt ceiling, Donald Trump lobbed a grenade. Knowing full well that President Joe Biden won’t simply cave, Trump urged Republicans to allow a default “unless they get everything they want. Do not fold!!!”

Lest you have any doubt, the three exclamation points are Trump’s. You could be excused for thinking he wants a default. He loves chaos.

But he also has a purely self-serving reason to seek an economic catastrophe. You don’t need to be a stable genius to know that a bad economy typically hurts the incumbent in a presidential race. And Trump is desperate to get the immunity from prosecution that being elected president would provide him. He’s terrified of what’s coming from Special Counsel Jack Smith. So he’ll apparently nuke the world economy to protect himself.

His MAGA minions in the House of Representatives also understand that voters’ first instinct for an economic crisis is to blame the incumbent president. But just in case that point was missed by the few GOP representatives who still worry a bit about what’s best for the country, Trump’s Truth Social post on Friday was sending them a message. He might as well have written, I’ll come after you if you vote to raise the debt ceiling."

SOURCE

Skud said Trump was number 2 in adding debt, after FDR.

True enough, even if I never said otherwise. FDR though did have to pay for WWII.

The next two presidents who added the most to the debt were Reagan and Bush #2. So three of the top four presidents who added federal debt were modern day Republicans.

As for tax cuts, they in fact act as an expense, since they limit income, which pays for your expenses. No smart family in the US will stop working, thereby limiting their income to a level that does not allow them to pay their bills. No smart family.

Rev, Could you further explain your last paragraph because it doesn't make much sense. The debt ceiling should be eliminated if it is just something to be raised when needed and the need comes from over spending. There are a lot of people who live beyond the means and must reduce their spending which is the problem. They cannot just demand a raise because they could not meet their obligations. The same should go for the government, spending is the issue. Increasing taxes on just the rich will have little impact but having everyone pay their Fair share would have an impact and would be Fair. Raising taxes on corporations serves no purpose because it is a pass through.

Skud, it's like this...

Let's take 2017 when Trump took office.

With all of our taxes, we, as the government, took in X.

Then we spent Y, which for many years, was and remains, greater than X.

So we have deficit.

Now, if you or i are sitting around a table with our families and this is our reality, we've got two choices.

1. Cut our spending

2. Raise our income

Now, there are some expenses you can't cut. Think food, housing, etc. So let's assume that at some point, our families cut all the fat out of the budget they can. And yet, our budget is still out of whack.

What do we do?

Now we look at the income side. You're right, in most cases you can't just go to your boss and ask for a raise. Usually. But perhaps someone in the family can get a second job.

But what you do not do when you are spending more than you bring in, is cut your income. Yet that is what every GOP president and admin has done, with the exception of Bush the Elder, since the Reagan Administration. Reagan, Bush II, Trump were all income cutters when we were in a deficit.

WHY???

It's insane. But yet, there's more. The GOP, which does not believe in government spending in areas of which they do not approve, has for years used those deficits, which they've created with their tax cuts, to then argue, as McCarthy is now, for cuts to popular programs, they oppose. All under the guise of fiscal sanity.

Yet it's a lie!

Because those supposed purveyors of "fiscal sanity" actually caused the deficit to grow.

Can you explain why they are doing this to us and the rest of America?

"Can you explain why they are doing this to us and the rest of America?"

I'm going giver Skud a hint.

It's about power, dominance, punishing others, and avarice feeding into each other.

Tax cuts for the wealthy have long drawn support from Republicans who argue that such measures will “trickle down” and eventually boost jobs and incomes.

A new study from the London School of Economics says 50 years of such tax cuts have only helped one group — the rich.

Rev, Fiscal responsibility will never be something out elected elite practice because they use spending to advance their career and it is not their money.

From what I have read the republicans are not advocating cutting the budget. They are proposing slowing spending to last year plus 1%, Don't spend the excess covid funds that were not spent, let people who took out student loans (mostly rich kids) honor their commitment and those able body people on welfare do some work. All that seems reasonable.

I am not for tax breaks for the rich but I am for everyone paying their fair share which means everyone pay something. The top 1 percent paid 42.3% of all federal income tax so why is it fair to not reduce that. How can you make taxing fair for everyone, The Fair Tax would accomplish that. Take away loopholes in our tax code that only favor the rich. Eliminate the tax break for buying an electric car, that only the rich can afford or want. Don't give away tax money so rich kids can break a contract.

The richest in the country pay little to no income tax. Bezos, Bloomberg, Soros, Musk paid zero. Is this their fault or is it the fault of our antiquated tax codes which favors the rich. Establish a graduated fixed tax rate for Everyone with zero deductions and a simple one card filing. You made x times % you owe Y. It could start with 3% and work it's way up to 30%. I cannot ever see that happening because FIT is a sword for politicians to use to get what they want. Maybe eliminate waste in government but that would cause layoffs in government and private sector jobs and politicians couldn't sell favors for millions.

No politician has the will to do what it takes to cut spending because they would not get reelected so we will just continue to blame the other and keep passing the debt on to our grand kids, great system.

Here's a few words from Roll Call on the current behavior of the GOP as it relates to the budget and deficit...

"Between 2017 and 2019, well before COVID-19 ever hit, the Trump administration increased the budget deficit by almost 50 percent, from $665 billion to $984 billion. In 2017 alone, Republicans passed tax cuts costing $1.9 trillion over ten years, according to the Congressional Budget Office, and every penny of it was borrowed."

In contrast here's what Biden has done... again, from Roll Call.

"Biden’s infrastructure proposal would spend $2.65 trillion over ten years, with most funding ending after eight years. At the same time, his tax increases would raise $2.75 trillion over 15 years. So within 15 years, the Biden plan would be fully paid for. And after 15 years, it would actually cut the deficit, eventually by a large amount. While all the spending is temporary, the tax increases are permanent. That means the tax increases would continue cutting deficits and promoting fiscal restraint for years to come."

Skud and the rest of you conservative lurkers, which approach is better? think about and get back to us.

And you believe the joey b plan will be fully paid for and there won't be more massive spending to make up for any "savings" joey b achieves. That exists only in an alternate universe. What about Everyone Paying Their Fair Share. Now we have some politicians who want to give away trillions to a minority because of something that was done to their ancestors and not them. Where does this madness stop.

I know which approach is better. Go to a flat rate tax or FAIR TAX and stop buying votes with taxpayers money. All of the joey b infrastructure plan is just that a plan with no basis on reality. The tuition give away program has already doubled the estimates. Why do we need to give tax breaks to the rich so they can buy an expensive car that for most people is not practical just to reward the rich. Why do we have to spend excess covid funds. The saying you get what you pay for but in the taxpayers case that is not true because of our overspending government. Both sides are responsible for the situation we are in and neither side will do what is right. You blame conservatives instead of blaming who is responsible, our elected elite.

You seem to know much skud, why don't you run for president? Perhaps you'll have the magic to put things in order and steer us on a smooth course. You certainly couldn't do any worse the tRump.

Skud stated...

"And you believe the joey b plan will be fully paid for and there won't be more massive spending to make up for any "savings" joey b achieves."

Nice try Skud. That project which the article referenced will be finished at some point. And there is no more money appropriated, nor will there be by the GOP House to keep funding it.

So, yes, it will end at some point.

I know that is outside how you think, but facts are hard. Tax breaks on the other hand do stay on the books forever, keep adding to the deficit and wreck us financially as a nation.

Cheers amigo...

Post a Comment