"On Thursday, a wave of protesters, upset with overly-burdensome taxation by the federal government, are set to descend on the nation's capital to express their displeasure.

But does their anger reflect the truth about today's tax rates?

After all, neutral economists insist that, under the Obama administration, the overwhelming likelihood is that your tax burden has gone down, not up. Even conservative economic analysts acknowledge that there really is no basis for middle- and working-class Americans to believe that they're suddenly paying more."

"The only tax I think that has been put in place so far is an increase in the federal cigarette tax. I can't think of another Obama tax that has gone in place so far," said Chris Edwards, Director of Tax Policy Studies at the conservative Cato Institute. "I would say that people are angry because big taxes are coming down the road because of the gigantic deficit built up under Bush and continued under Obama."

And yet, Thursday is expected to bring a range of hotly-charged rhetoric over the damage this 'tax-and-spend' president has done to the general public's bottom line.

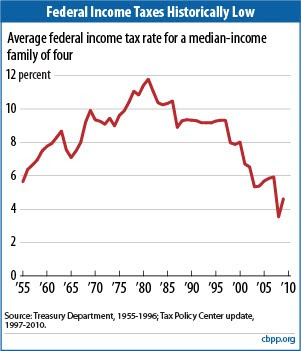

A look at the numbers tells a different story. For starters: the non-partisan Center for Budget and Policy Priorities reported on Wednesday that "Middle-income Americans are now paying federal taxes at or near historically low levels." How low? The average family of four right now is paying 4.6 percent of its income in federal income taxes -- the second lowest percentage in 50 years."

[The Tea Partiers don't let facts get in the way of their group discontent.]

"A report from the White House Council of Economic Advisers, meanwhile, asserts that the president's economic stimulus package has sent more than $200 billion in tax relief and other benefits to mainly middle- and lower-income families since its passage.

Citizens for Tax Justice, a self-described non-partisan organization, released a report on Tuesday that read: "The 2009 economic stimulus bill actually reduced federal income taxes for tax year 2009 for 98 percent of all working families and individuals." This total includes the 95 percent of working families that will or have received tax credits in the range of $400 to $800.

The health care bill passed by the administration, meanwhile, includes a tax credit that could cover up to 35 percent of the premiums a small business pays to insure its workers. The Recovery Act, meanwhile, included such tax breaks as a $1,500 credit for home energy improvements, and an $8,000 credit for first-time home buyers. "

From Sam Stein

Yesterday, on Boston Common, the Tea Partiers held signs depicting the Hammer and Sickle and President Obama. IOW, he's a Commie because he gave the people holding those signs a tax cut.

TEA PARTIERS: THEY'RE ANGRY; THEY'RE LOUD; BUT MOST OF ALL, THEY'RE CONFUSED.

13 comments:

Having just finished my income taxes, I can attest to the new tax breaks for 2009/10. I had tax breaks and credits I've never seen before which lowered my taxes significantly for the first time in years.

Give it up teabaggers. Your moronic rhetoric are as empty and dry as a three day old scone in the Los Angeles River, even with Minnie Mouse singing you her lullabies

I owed $1800 last year and this year I owed $28.

42% of Tea Partiers think their taxes have been raised.

They're wrong. The go a tax cut.

This is the triumph of the stupids at FOX News and the Queen of Stupids, Sarah Palin. They're all doing their best to lie to Americans and they don't care what is ruined by their lying.

First of all, this is before the government health care taxes kick in.

Second, this is really bigger than just Obama. It's about the shell game of taxes that Washington plays while finding newer and harder-to-track ways to tax us. It's also about the other half of the equation, the roller coaster spending orgy we've been on for the past 30 year.

Third, Bob, most TEA party people aren't preferential to having ballsacks dangled in their mouths. I don't have an exact percentage, but I'm guessing it's a small one.

A lot of the teabaggers are rich. That's part of why they are whining.

libhom: they're whining because they're rich - or they're whining because they don't have to pay taxes because they're rich? ; )

You have to understand the rich TNLIB. While there are a few that are genuinly good folks, most of them are greedy selfish pigs that guard their wealth like mother bears. Even when giving to charity it always has to serve them in some way. Just as Walmart spends more advertising it's good deeds than spending on them, most of the wealthy demand homage and patronage of their businesses for their good deeds. Their wealth must serve them. For it to serve the society and system that made their wealth possible is a foreign concept to these people because gred and selfishness are not part of the equation.

People like Patrick who's beliefs fly in the face of their own interests are motivated by greed also. Theirs is a hope that a wealthy person will feel benevolence toward them and shower them with "trickle down" stuff. It never happens Patrick. I never got shit from an employer until I got a union job and joined the negotiating committee.

Thanks for this posting, Shaw. Very good job!

The taxed enough already thing is making me insane.

Loved the banner photo so much that I stole it.

I would like to see how much Sarah paid on her 12 million...

Perhaps the Tea Partiers are smart enough to figure out that all of the president's tax cuts are temporary, while all of his tax increases are permanent.

It's a small distinction, but small things matter.

I'm glad you got out to see the rally. It's a shame that one glimpse of that red leather jacket caused you to lose your hearing, though.

101: Yes, i speak against my own narrow-ass self-interest. There's a reason.

I'm not taking anyone's "side" in getting the tax code fixed. I guarantee that at some point in the next few weeks, most of the liberal blogs I read will find some EEEVIL corporation or some soulless rich bastard that "didn't pay their fair share" and should be penalized by the righteousness of Obama. The point is, you'll be bitching about how unfair and rigged the tax code is. As I look down the comments, this is exactly what I see.

And if you can't agree that the tax code is designed to benefit one group or another depending on the political flavor in Washington, then you're a damned fool.

"And if you can't agree that the tax code is designed to benefit one group or another depending on the political flavor in Washington, then you're a damned fool."

Why are you attacking me with this statement when I have never posted anything that would be in disagreement Patrick?

And tit for tat Brother' why the hell are you in favor of souless rich bastards and greeedy corporattions getting tax breaks and loopholes?

Don't give me shit about they're creating jobs either cause that's bullshit. Their stock goes up when they cut jobs. It goes up when the Wall Street Journal reports they cut employee benefits or outsourced work to China.

I won't be standing next to you when you deliver your glowing testimonial to the benevolence of corporations Patrick. Maybe Michelle Bachman will show you some leg for your trouble then give some friendly advice. Like getting a job that has health insurance but don't bother applying at her business cause her business doesn't make it available to employees.

101: And tit for tat Brother' why the hell are you in favor of souless rich bastards and greeedy corporattions getting tax breaks and loopholes?

Okay, this is the problem. You see everything as a versus situation. Rich vs poor, big EEEvil corporations vs the little guy, x vs y.

The problem with this is that the tax code really shouldn't. It shouldn't be giving "tax breaks to the rich" or "benefit the poor" or do ANYTHING other than simply collect revenue to operate the federal government.

The GOP and the Dems both use the tax code to benefit their constituency. And this is one of the things that the Tea Party is about. And yet I point this out, and I get mocked for sucking rich tit (which is what sets me into attack mode).

To go a little socialist(ish) here, we need to stop trying to divide by class and strive toward the concept of classlessness. Especially where the tax code is involved. If I'm starting to sound radical, it's because any tax reform that will mean anything has to be radical.

Post a Comment