Dave Miller:

Our friend Skud makes it a regular part of his comments to moan about the inability of Congress to cut spending. This is part of the supposed GOP fealty to balancing the budget, something only accomplished during one administration in the last 50 years.

That of course was when Bill Clinton was president in the 1990’s. Early in the Clinton Admin the Dems pushed through a series of tax increases, which every single House member of the GOP opposed, claiming those tax increases would wreck our economy. We know of course that did not happen. In fact the economy boomed, the budget was balanced and we paid down our debt.

Then George W. Bush was elected president and the era of massive budget increases was born with a tax cut that deprived the US Government of the money it had been using to balance our budget and continue to pay off the US Debt.

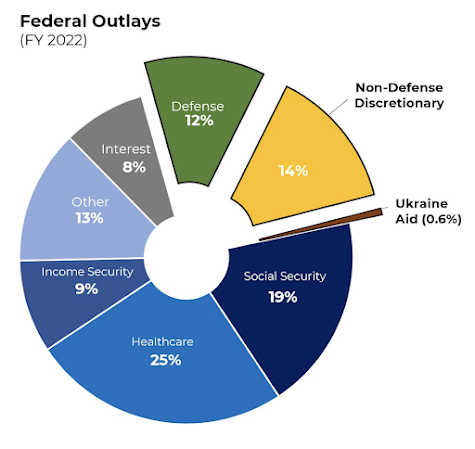

However, balancing the budget and cutting spending continues to be a standard GOP and conservative talking point, even if they don’t mean it. But to really understand how difficult the process is, take a look at the chart below from the inimitable Steve Rattner.

Very clearly, it shows where our federal tax dollars are spent.

By all accounts, the entire federal budget equals about 6.5 trillion dollars. In any book, that’s a lot of money spent each and every year by the federal government. According to US Government figures, we are currently spending about 1.5 trillion dollars more each year over what we bring in.

That means to balance our annual US budget, we need to do one of three things…

- Cut spending 1.5 trillion dollars

- Raise revenue 1.5 trillion dollars

- Enact some mix of spending cuts and revenue increases

There’s no other way.

Now, for those who advocate making that happen by only cutting spending, here’s what that means. In the chart above, the yellow section represents what all politicians currently call discretionary spending. Here are some of the programs it includes.

- Title 1 education grants for the poor

- WIC nutrition assistance

- Affordable housing subsidies [Section 8]

- Immigrant Refugee aid

- Head Start

- EPA Clean water programs

That yellow block of budgetary spending is about 14% of the federal budget, or 900 billion dollars. If we add President Biden’s proposed Ukraine spending of about 60 billion dollars, we can round up and say US discretionary spending comes in at a cool one trillion dollars.

Cutting every penny from those discretionary programs would leave is about 500 billions short of a balanced budget. That money would have to come from cuts to defense and entitlements.

Conversely, if we decided to keep that spending as is and make up the difference in tax increases, we would need a net across the board tax increase of approximately $5000 for every person living in the United States of America.

Neither of those two approaches are possible, or sustainable and even if they were, that would just balance the annual budget, doing nothing to actually lower the US debt.

Both Joe Biden and Donald Trump have said that entitlements, which include Medicare, Social Security and all the other needs based income security programs in Rattner’s chart are off the cutting table, as is defense. Economists say we somehow need to eliminate our spending/income gap of 1.5 trillion dollars and get an additional 500 billion to apply to our debt. Otherwise with increased interest on the debt, we are in danger of real US default, which would be a global calamity.

So what do we do?

The US financial house is in a pinch. Right now the economy is growing, even if only at a small amount. This is when we should be getting our house in order and paying down debt. We’re not at war and while inflation is still too high and people may not “feel” like it, Americans by and large are doing pretty well.

Most people can look at the numbers above and realize we’re going to need a reasonable solution of some spending cuts and some tax increases. In a word, America’s political parties and leaders are going to have to compromise.

Conservatives will get some cuts and progressives will get some tax increases. And then both sides will figure out how to live with those results.

Sadly, like a lot of the thorny issues we face today, immigration and election security among them, our political parties are pulled from the center outward to the partisan edges, fracturing the more centrist governing coalitions we need to survive and solve the real world challenging problems we face.

Additionally, right now, there seems to be only one party that seems to be serious about even trying to govern. Skud and conservatives are right. We do need to cut spending. But talk of balancing the budget purely on the cutting side of the equation, without considering revenue increases is both irresponsible and short sighted.

18 comments:

Thank you for this informative post Dave. It points to the core of our financial mismanagement and to the party that bears the lion's share of resonsibility for it.

As you know Dave i was once a staunch republican (24 years ago), and the core underlying reason the party did not retain my loyalty rests in precisely what you've so accurately presented for our consideration here.

Now the republican party is in the deep woods and seems poised to run even deeper yet into the woods of financial mismanagement and wishful beliefs, rather than actual fiscal and financial realities.

Yes, we need to cut spending. We also need to balance spending cuts with revenue increases. Balance and reasoned thinking is, in my considered opinion, gravely lacking in the gop and the "conservative" movement.

BTW folks, of course there's a typo. They seem to leech in no matter how many times you proof it.

There's a sentence that includes the following...

"President Biden’s proposed spending of about 60 billion dollars..."

It should read...

"Add in President Biden’s proposed Ukraine spending of about 60 billion dollars"

Sorry...

RN... thanks. I'm coming around to the reality that I'm an old line Rockefeller type of Republican. Fiscally conservative, socially laissez faire... And like any conservative at the dinner table, when you've got to make ends meet, sometimes someone needs to get a second job to bring in more income.

I think that's where the US is. We need to control and limit our current spending and increase revenue to get us out of this hole. We did it before, we can do it again. If we have the will to do so and people really want to fix the problem.

As opposed to campaigning on it.

Sell all the Federal Land in Utah to people making less than $250k per year. People making more than that are ineligible, and buyers would not be entitled to sell it during their lifetimes. All foreclosures would revert back to the Federal Government.

Rev, I admire the amount of time and information you provided although I have issues with some of it (shocking I know). It must be frustrating to understand why people who work and pay almost 50% of their income in taxes object to paying more. You look at it from a different perspective because you rely on people giving assets away because they get a tax break. I do not object to paying taxes but want my money to not be wasted and that is what our politicians do. As I have said many times the only a thing politician does is spend our money, look for ways to get more of it and keep their job so they can become richer. They serve no other purpose and the country should be managed by a BOD.

No party or politicians is going to do what it takes to balance the budget and that applies to both parties even if leslie will only blame the GOP. How much of what is spent is beneficial to the recipient. Now we have us spending billions to support people who have entered our country illegally, I know you view the border as not open when even the governor of NY, mayor of NYC, DC, LA says it is. Thousands a day crossing is not a controlled border.

Giving billions away so rich kids don't have to honor their commitment to repay a loan for a degree in a worthless degree and ignore the middle class kid who goes to welding school and comes out with a high paying job.

We could go to a single issue bills instead of adding billions in pork and when the bill fails the other party can place blame. Do we need anymore bridges to nowhere or should we spend the taxpayers money for what matters.

Well Skud, you don't disappoint.

I'm not going to respond to the specific items in your response because they're not germane, or you're purposefully not being serious.

Single issue bills, cut this, cut that, it doesn't matter.

Immigration falls under discretionary spending. AFDC, WIC and more, as I pointed out. Cut is all 100% and we're still a trillion short of our goal.

What are those things that matter to taxpayers... in your opinion.

Thank you for this informative post Dave. It points to the core of our financial mismanagement and to the party that bears the lion's share of resonsibility for it.

As you know Dave i was once a staunch republican (24 years ago), and the core underlying reason the party did not retain my loyalty rests in precisely what you've so accurately presented for our consideration here. Npo I'm a member of the Idiot Party like you are.

Rev, I won't issue a snark because because you don't agree with me but the answer is simple and one that you have voiced a agreement with. Everyone needs to pay their fair share. What do you believe is a fair share? You seem to believe that a billion here and a billion there are insignificant but enough billions saved can add up to real money. Should we forgive tuition to a rich kid because they want to buy a new car and default on their loan agreement. Do we need to spend what we spend on protecting the world since the rest won't contribute their fair share. Do we need to pay someone who can work but chooses not to. Should we make SS to start at a higher age since we live longer and should we contribute to SS for all the money earned instead of the first 160K. Should we drain SS paying all the other non contributed entitlements. Should we treat charities and religion as a business and get rid of their tax exempt status.

A single issue bill would make our elected elite think twice about the pork they pass. The military is bloated with insufficiency, cost overruns and non motivated workers but if it is in a politicians area it is hands off. Would we be better off turning a lot of things the military does to private companies who have a profit motive to increase efficiency . Yes we have thousands of contract workers but they are managed by the same people who ineptly run the military.

There are a number of things that can be done but your solution is to just raise taxes and let the government continue to overspend.

Skud... what does this mean? "Everyone needs to pay their fair share."

How do YOU determine it [a fair share]?

Let's say you're king for a day and change anything you want. What rate of taxes are you in favor of for everyone to pay their "fair share".

You use that term all the time. Fine. I get it, it sounds good. Now make it practical. Tell us the percentage people should be paying. And remember, we need to get to 6.5 trillion, so we need an additional 2 trillion in combined savings and new revenue.

You say in a another lie, as is typical of you as it relates to me... "There are a number of things that can be done but your solution is to just raise taxes and let the government continue to overspend."

I've never said that. I've never written that. But you say it, without proof, evidence or any backup material. Why? Because you lie. You must know what you wrote about "my solution" is not true and was not in this post.

So why say it? Because Skud, you lie. Or just don't care about the truth.

You raised some good questions as it relates to Social Security in your response. But I am at a loss to explain why you continually attribute things to me that I have never said. In fact, in my post I explicitly said... "Neither of those two approaches [balancing the budget with all spending cuts or tax increases] are possible, or sustainable and even if they were, that would just balance the annual budget, doing nothing to actually lower the US debt.

Please provide the quote, or evidence that supports your view that my "solution is just to raise taxes" and "continue to overspend."

Can you do that? Because if not, you're just lying. Again.

Anon... thanks for the copy/paste and edit of RN's post.

One of the great propaganda victories for the Right is the indoctrination of public of the myth that Republicans are better for the economy.

Rev, You are the one who says that everyone should pay their fair share. I favor a Fair Tax system because then everyone would pay their fair share but that would take the taxing power from congress so that won't happen. I won't say you lie because I don't believe you do, you just have a different view on the current situation. In todays hate filled society if you have a different view you are not wrong just have a different prism.

Skud... I'll repost my question, which you avoided...

Please provide the quote, or evidence that supports your view that my "solution is just to raise taxes" and "continue to overspend."

Just show me where I said or wrote that, or... admit you lied or made a mistake. But don't continue to impute words and views onto my writings that are not there. Why is this so hard for you to acknowledge?

Especially since the proof is clearly right here...

Rev, I do not archive the comments so I cannot quote what you said. Perhaps you didn't say exactly that you are for increasing taxes but you did say "increase revenue" and that means a tax hike because how else does the US increase revenue since their revenue is derived by taxes. Since donnie cut taxes for the rich and the poor don't pay taxes it all comes from the middle class. I won't sling insults at you because that is not whet I do but I believe I am correct in this matter.

Nice try Skud. You. Are. Lying.

You are not correct. All you have to do is read the post. It's not in any archive at all. It's right here, on Shaw's blog. And this comment thread.

You won't find the statement you attributed to me, because it does not exist.

You are being purposely ignorant so as not to disrupt your world view. Then when you are called on it and presented with the facts, you purposely ignore the evidence and those facts.

Ask yourself why you are like that Skud and why you continue to defend a lie. Why?

Your post "progressives will get some tax increases"

Your post 10/5 1601 "increase revenue"

Can you please explain how a government increases revenue without increasing taxes since they produce nothing and the only way they can increase revenue is to increase taxes. I do appreciate you calling me ignorant for pointing out your in favor of raising taxes. How is that a lie since you made it.

Ask yourself why being called out on the statement you made, I may not have quoted you verbatim but did hit your opinion. Was it because I said charities and religions should not be tax exempt and that hit an exposed nerve? Your statement that you never said that is about as ridiculous as your saying I am a trump supporter.

Context Skud, context... the entire gist of the post was about what our options are. I see three, as I noted in the post...

Here it is verbatim...

...to balance our annual US budget, we need to do one of three things…

-Cut spending 1.5 trillion dollars

-Raise revenue 1.5 trillion dollars

-Enact some mix of spending cuts and revenue increases

There’s no other way.

Additionally, I said this...

"Neither of those two approaches [cutting 1.5 trillion in spending or raising taxes/revenue by 1.5 trillion] are possible, or sustainable and even if they were, that would just balance the annual budget, doing nothing to actually lower the US debt."

My conclusion in the post was this...

"Most people can look at the numbers above and realize we’re going to need a reasonable solution of some spending cuts and some tax increases. In a word, America’s political parties and leaders are going to have to compromise."

Finally, I affirmed your view about cutting spending with this...

Skud and conservatives are right. We do need to cut spending.

So, if you're still with me, tell me where I stated, wrote, represented or advocated what you said here...

[Dave], "your solution is to just raise taxes and let the government continue to overspend."

I never, ever said I favored no tax increases. Nor did I say I favored no spending cuts. You're just wrong, or again, lying. But since I have the receipts, right here on Shaw's blog, I'll take lying for $500.00 Alex.

Look, everything should be on the table. We need to balance the budget, with I believe, a mixture of tax increases and spending cuts.

For some reason, maybe because you are challenged with reading comprehension and probably struggled with the old SRA reading tests, you are reading your bias into my words, without paying attention.

I got kicked off Geeez because I believe words matter and when you post stuff as fact, and get called on it when it is shown to be wrong, or not accurate, I believe ppl need to own up and do the right thing.

I've done that here, heck, I've done that here in response to you.

You however seem unable to do that. Ask yourself why...

Rev, Agree that we need to cut spending and have everyone pay their fair share of taxes. We have a system where only 58% pay any federal income tax which leaves 42% paying none. The idea that the democrats will cut spending and that the republicans will increase taxes is not going to happen. Both sides live for more pork and cutting spending is not an option for either side. Eliminate all deductions including religion and charity and either go to a fair tax or a flat tax system. That way everyone can participate in the financial affairs of the country not just 58%.

Tax the churches, especially TV ministers and the mega-churches with their filthy rich masters.

End corporate personhood and restore tax rates of the "good old days" of 1945>1972.

That's how you make America great again.

Post a Comment